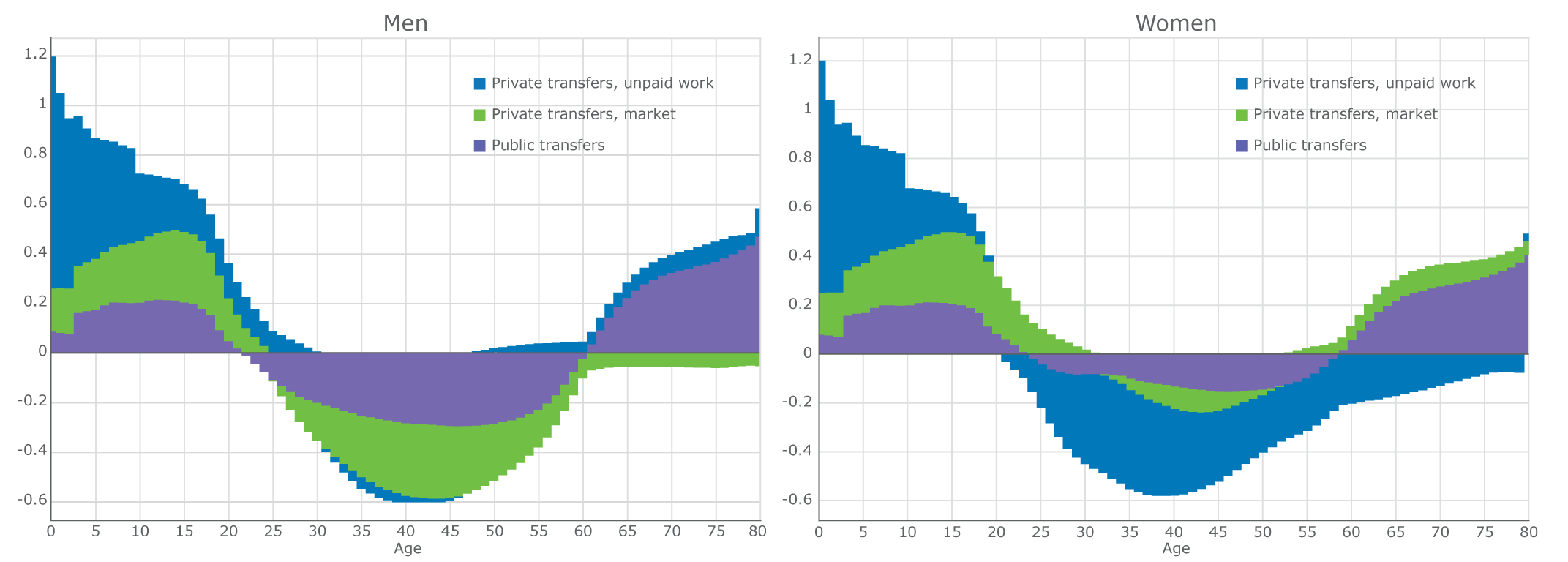

The human life course is characterized by long periods of economic dependency in childhood and in old age. In Europe, these periods of life are largely supported by transfers from working adults: parents provide most of the support for their children, and the employed population funds the pensions and health services of older people through income-based taxes and social contributions. These support payments are often termed “intergenerational transfers.” Because of their higher employment rates and higher income, men finance more of the needs of older people and the market transfers to children. In turn, unpaid housework and childcare constitute important intergenerational transfers that are largely provided by women. Taken all together, what are the main differences in contributions between men and women? What about gender differences in how much men and women benefit from transfers later in life? And are there differences across European countries?

In a new study, Bernhard Binder-Hammer (Vienna Institute of Demography) and colleagues analysed gender differences across 15 European countries. Their analysis is based on the European National Transfer Accounts (NTAs) and the National Time Transfer Accounts (NTTAs) available on www.wittgensteincentre.org/ntadata. These data provide comprehensive cross-sectional information on age- and gender-specific income, transfers between age groups and genders, and on age- and gender-specific consumption. It includes information on public transfers, such as pensions, health services, and education; private transfers, such as goods and services bought for other household members; and non-market transfers such as childcare.

In general, Binder-Hammer and colleagues found that men and women benefit significantly more from transfers than they contribute over the life course. On the one hand, below-replacement fertility means children receive larger transfers with moderate contributions from parents. On the other hand, generous public pensions for older people are financed by the large cohort of baby boomers in the workforce.

In terms of contributions by gender, the authors found remarkable differences across countries. For example, when the authors value each hour of unpaid work using the average net hourly wage in the country, women and men contribute about equally to intergenerational transfers across the lifetime – on average across all countries. However, in Spain, Italy and Slovenia, women tend to contribute more of their time to paid and unpaid work and therefore contribute considerably more to intergenerational transfers than men. In Austria, Germany, Sweden and the UK, women and men tend to devote equal amounts of time to all types of work. But because market work is given a higher valuation, the value of lifetime contributions are higher for men in these countries.

Figure 1: Transfers in relation to yearly labour income over the life course for men and women.

The study also demonstrates significant gender differences not only in contributions over the lifetime, but also in net benefits from the pension system. Women receive lower yearly pensions in most European countries, in large part due to their lower involvement in market work. However, because women retire earlier and live longer, they receive larger net benefits from pensions than men over their lifetimes: while men spend 16 years on average benefiting from public transfers, women benefit for 23 years. That said, yearly pension benefits remain lower for women. Binder-Hammer and colleagues’ findings serve as important considerations for policymakers who want to consider gender differences when making policy decisions for parents, pension recipients, and workers.