Most welfare states in Europe have taken measures to make their public pension systems more sustainable, not only by increasing the retirement age but also by placing additional responsibility on individuals to close the pension gap through personal savings and private pension plans. A cross-national study by Douglas A. Hershey, Kne Henkens and Hendrik P. van Dalen investigates who worries most about their financial future in retirement and who takes active steps to ensure an adequate standard of living when retired.

Some people worry more about income in old age than others

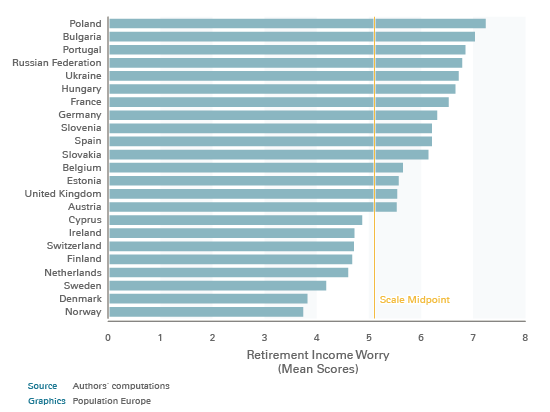

More than 20.000 people aged 18 to 60 years of age from 19 EU-countries, as well as Switzerland, Ukraine, Norway and the Russian Federation, were asked whether they are worried that their income in old age will not be adequate. The countries where people were most worried about their income level in old age were Poland, Bulgaria, Portugal and the Russian Federation, whereas respondents living in the Scandinavian countries displayed the lowest income concern overall (see also Figure 1).

Figure 1: Worried that income in old age will not be adequate

(scores from 0: not at all worried to 10: extremely worried, mean values by country)

People in more economically vulnerable situations, such as individuals closer to retirement age with fewer opportunities to supplement their incomes on a private basis, female and less educated workers, as well as people suffering from health impairments particularly expressed worries that their later years will not be adequately covered financially. From a more psychological perspective, those who maintain future-oriented perspectives, yet prefer to not plan and prepare in advance, are particularly concerned about their financial futures after retirement.

Finally, the researchers found that individuals react to the current situations in their countries with respect to their financial prospects after retirement: For example, in countries where there are projected to be many retirees relative to workers, people tended to be more worried than in countries with more workers to support retirees through state-based pension programs.

Saving for a comfortable life in old age

Worries about the financial consequences of retirement can be partially alleviated by engaging in financial planning activities and setting aside resources for the future. In this context, the survey participants were asked whether they are saving or have saved in order to live comfortably in old age (see Figure 2).

Figure 2: Saving for old age

(proportion of respondents, in percent)

Again, the results reveal strong country differences: Those countries where future income related worries are particularly high, such as Ukraine, the Russian Federation, Bulgaria and Poland, are also the countries where only 25 to 35 percent of the population has been able to set aside financial resources for their old ages, whereas about 80 percent in Denmark, Austria and Slovakia have been able to do so.

Furthermore, a more detailed analysis of the determinants of private saving for old age reveals that good savers are characterized by high education levels, full-time employment and like both thinking about the future and planning for it.

Towards sustainable pension systems

To sum up, income-related worries about one’s financial future after retiring and actively putting aside resources on a private basis strongly depend on the economic, social and psychological resources the survey participants have at their disposal. Moreover, the authors of the study suggest that European citizens are generally aware of the effects that demographic developments, such as the increasing proportion of retirees to workers, have on the sustainability of their pension systems.

However, making state pension systems more sustainable by postponing retirement age – which should have reduced worries and decreased motivation for private savings – did not have the expected effects. With these findings in mind, the authors invite policy makers to further explore whether the average citizen has either not been able to grasp the positive consequences of later retirement on their old-age financial prospects, or instead does not see later retirement policies as a realistic and credible solution for keeping the public pillar of pensions sustainable.

This Population Digest has been published with financial support from the Progress Programme of the European Union in the framework of the project “Supporting a Partnership for Enhancing Europe’s Capacity to Tackle Demographic and Societal Change”.